WeChat Pay is the payment system that grew out of WeChat super app. Nowadays, just like Alipay, it is widely used for both online and offline payments.

History

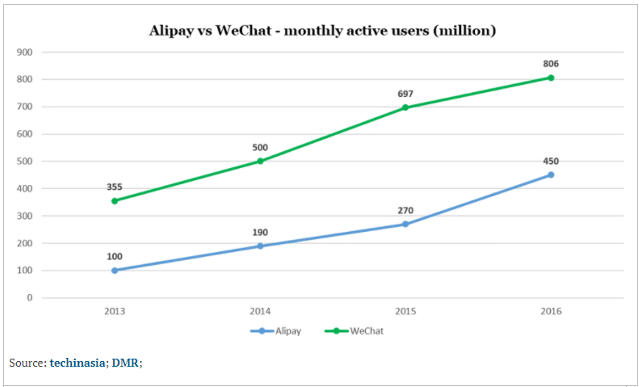

WeChat Pay is a relative newcomer among Chinese payment systems but it managed to gain traction almost immediately, surpassing AliPay in the number of registered users, although not in total transactions volume.

The vast majority of WeChat users, the number that is quickly approaching one billion, are also WeChat Pay customers as long as they have linked their account to their banking. WeChat Pay has gained additional momentum with the introduction of the “red envelope” feature – a cherished Chinese tradition of gifting money to friends and relatives on special occasions. During holidays, this feature of WeChat is by far the most popular one with transactions volume running into billions within hours.

Usage

In terms of various uses, WeChat Pay closely follows AliPay. It can be used to pay bills, buy goods online and offline, order tickets, grocery deliveries, hail a cab and do just about everything else. In addition, WeChat Pay powers rapidly growing WeChat ecommerce ecosystem, making buying and selling products with WeChat online stores a smooth and secure experience.

Moreover, WeChat continues to expand its services to various financial products – from investment funds to insurance, allowing users paying for that with WeChat Pay and from within the app.

In offline settings, WeChat Pay works pretty much in the same way as AliPay – using system generated dynamic QR code. In fact, both systems have become so popular, that it’s a common site to see WeChat Pay and AliPay QR codes next to each other at points of sale.

Supported devices

Since WeChat Pay is an integral part of WeChat app, it naturally works with every mobile device the app can be installed on. 90% of smartphones in China have the WeChat already installed, making WeChat Pay to be the most convenient payment system to use anyway.

It is a bit clunkier to use on a website – rather than following a link, users have to scan QR code with their phone in order to process the payment. However, since most people nowadays are surgically attached to their phones anyway, this doesn’t present a major inconvenience.

Transaction fees

Transaction fees structure with WeChat Pay is very similar to AliPay – it is free for most transactions. The fees of 0.1% start at withdrawals over 10,000 RMB as well as overseas transactions such as in case of cross border commerce.

An easy work around to avoid paying those fees is to buy WeChat various wealth management products and then move the money from there back to user’s bank account.

Acceptance overseas

Compared to AliPay, WeChat Pay is much less common outside of China, although recently, it’s been making inroads into new markets. It currently support 9 currencies (still short of 18 supported by AliPay). WeChat Pay has to comply with the same restriction faced by AliPay and imposed by China’s central bank on money outflow.

In recent years, WeChat has struck new deals with operators overseas, namely in South Africa, Philippines, Thailand as well as other countries to facilitate cross border transactions. They have also partnered with global payments technology company, Adyen, helping businesses worldwide to access new customers in foreign countries.