Chinese digital payment systems are helping to create a true cashless society and it’s happening faster then anywhere else in the world.

The rapid adoption of digital payment systems continues to transform Chinese economy and society in unprecedented ways. Nowadays, handling cash seems like a thing of the past with nearly everyone in China using one of the two main payment systems: AliPay or WeChat Pay.

When is comes to digital payments, China is, undoubtedly, the technological leader. Once Chinese payment systems have become the primary payment method online, brick-and-mortar stores started to adopt them for offline payments as well.

Today, practically every business in China, big or small, finds it much more convenient to settle bills via AliPay or WeChat Pay compared to traditional cash.

Several factors are responsible for such universal adoption of digital payments in China. The fact that it is backed by ecommerce giants such as Alibaba and the top tech innovator, Tencent, was the most critical component. Also, as it turns out, having digital cash is a much safer way to handle money in China – it is harder to lose, there is no problem with fake bills and there is almost always a recourse to get money back in case of a fraudulent transaction.

Another big reason for wide adoption of digital payments in China is the fact that those platforms integrate seamlessly with a bank accounts using real name authentication. This is another reason why the fraud with those system is rare and much harder for criminals to pull off (although it does happen).

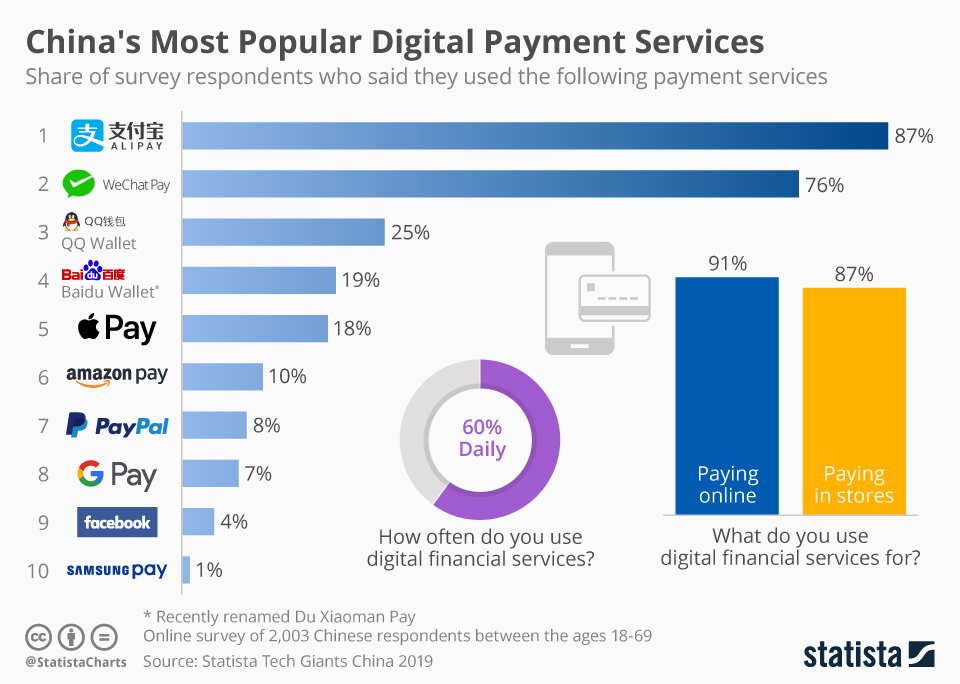

Two if the largest Chinese payment systems are AliPay, backed by Alibaba and WeChat Pay, introduced by WeChat maker Tencent. Although, WeChat Pay was a relative late comer, it quickly catches up with AliPay in terms of market share.

In fact, most Chinese have both AliPay and WeChat Pay wallets and use them interchangeably. Other payment systems platforms have sprung up as well, achieving a fare amount of success, although nothing on the magnitude of AliPay or WeChat Pay.

QQ Wallet is a system used by QQ, an ecosystem of apps and digital products by the same Tencent. Baidu has it’s own system called Baidu Wallet which was launched even earlier then WeChat Pay.

Out of non-Chinese payment systems, only ApplePay has reached some degree of recognition, although it enjoys much less popularity. Since it uses NFC technology, it often cannot be used with more popular Android phones. QR code based Chinese payment systems of AliPay and WeChat Pay are much more flexible as they don’t require any special reading devices besides a simple camera.

AmazonPay, PayPal and others remain relatively unknown and are unlikely to gain any meaningful market share in China. One of the issues with those platforms are high transaction fees when funds are withdrawn back to a bank account. AliPay and WeChat Pay don’t charge anything for the amounts that most people use them for (some fees start to kick off when a certain transaction limit is reached).

Here is the chart put together by Statista showing the market share of various Chinese payment systems: