When Alibaba goes public this week, New York stock exchange is going to see the biggest IPO in its history. The company is expected to raise more than $20 billion, bringing its value to over $150 billion, this will put it alongside other online tech giants like Facebook, eBay and Amazon. However, unlike those three, Alibaba has been virtually unknown outside of China until most recently.

Alibaba Timeline

Alibaba was founded in 1998 by a former English teacher, Jack Ma, with mere $60,000 from a group of early investors. Since then, it grew to dominate China’s B2B ecommerce with Alibaba.com, online platform that connects mainly Chinese exporters with companies in over 190 countries around the world.

Then, in 2003, it launched Taobao, the largest C2C ecommerce site, followed by TMall in 2008, which conquered B2C ecommerce space.

Alipay, the dominant online payment provider that facilitates transactions on all of those platforms and many more, was launched in 2004. It now handles about half of all online payments in China.

In October 2010, Taobao beta-launched eTao, a shopping search engine. In 2009, coinciding with its 10-year anniversary, Alibaba Group established Alibaba Cloud Computing.

Most recently, in July 2011, Alibaba Cloud Computing launched its first self-developed mobile operating system, Aliyun OS over K-Touch Cloud Smartphone.

Is it really worth 150 billion?

Many believe it does. After it floats, Alibaba will be worth roughly as much as Amazon but in terms of gross sales, it makes more than Amazon and eBay combined. Also, unlike Amazon, it makes significant profits.

In addition, Alibaba stands in much better position to continue growing, even if its entire business stays in China. Chinese ecommerce market has been growing at double digits rate and penetration is still much lower than in the West.

Moreover, Alibaba continues gaining strength in rapidly developing mobile commerce segment. According to iResearch, a consulting firm, over four-fifths of all m-commerce in China now takes place on Alibaba’s mobile platforms. Nearly a third of the firm’s transactions, as measured by the value of the goods, now take place on mobiles, up from just 12% a year ago.

How does Alibaba make money?

Unlike eBay, Alibaba doesn’t charge for listings and its Alipay service has no transaction fees. Instead, most of the revenues come from advertising on its various sites. Considering that there are 279 million active buyers and 8.5 million active sellers on Alibaba’s online services every year, it isn’t hard to see why advertising on those sites brings so much cash.

In addition, Alibaba charges millions of its sellers commissions, as well as various annual, maintenance and setup fees.

Alibaba’s future plans

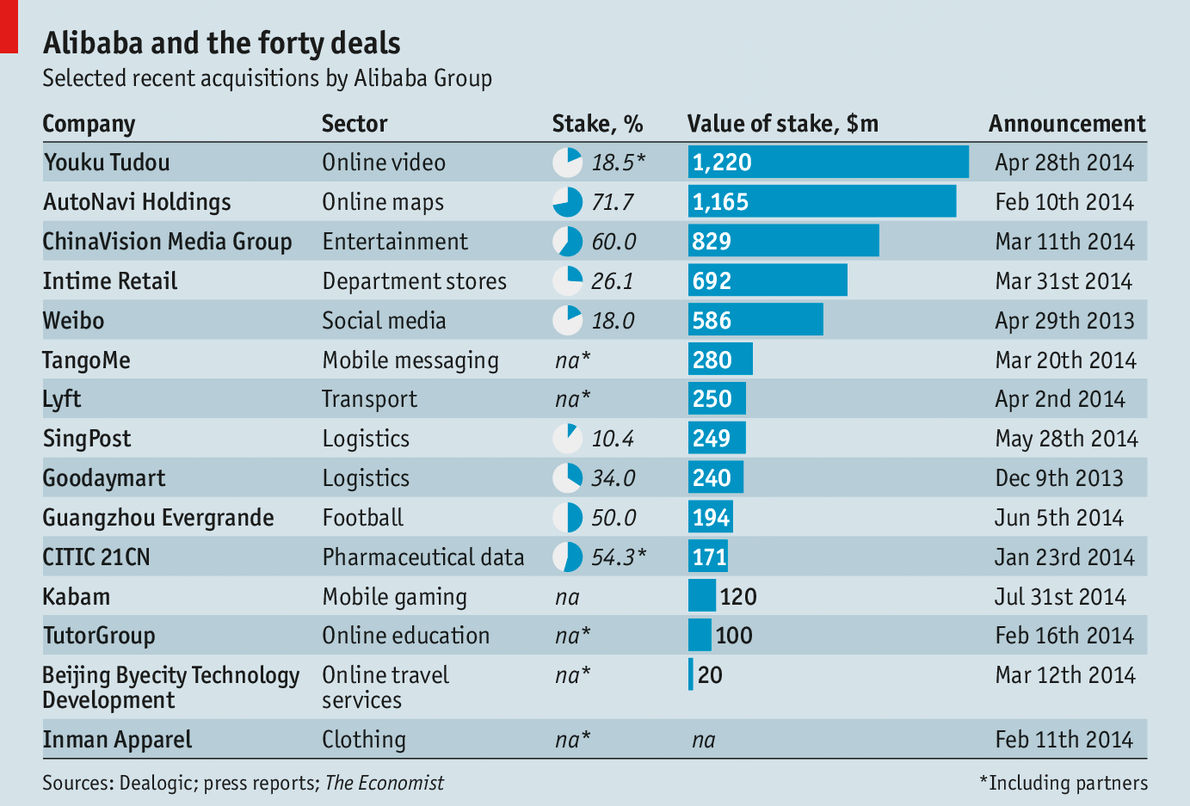

No one can be certain about Alibaba’s plans for the future but we could get an idea from the recent shopping spree they have been on. From the beginning of 2014, Alibaba has bought several smaller tech companies as well as large stakes in already established big ones.

By far, it’s largest acquisition was that of over 18% stake in Youku-Tudou, major online video hosting service, for reported $1.22 billion. 71% of AutoNavi, online map company, was the second largest acquisition at $1.165 billion. 60% of ChinaVision Media from the entertainment sector, has cost Alibaba another $829 million.

The company now also owns 18% stake in Weibo, one of the largest Chinese social media platforms. It also bought TangoMe (mobile messaging) and Lyft (transport) for undisclosed amount.

Here is the full list of the recent Alibaba’s acquisitions from the Economist:

Overall, Alibaba now owns companies ranging from logistics and sports to mobile gaming and travel services. It certainly seems that Alibaba is set to expand its advertising business to other platforms, not only ecommerce. Clearly, all of those companies can be plugged into existing Alipay payment system further increasing its reach, possibly even beyond China.

Although, Alibaba most likely will remain focused on China’s market, the expansion to other Asian countries and beyond seems like something that makes perfect sense at current stage of company’s evolution.