Over half of online sales in China have been done with smartphones making Chinese m-commerce the fastest growing sector of the country’s digital economy.

In China, smartphones are involved in every step of the typical sales funnel – from discovery and research to payment and feedback. As a result, Chinese m-commerce has been undergoing meteoric rise in recent years.

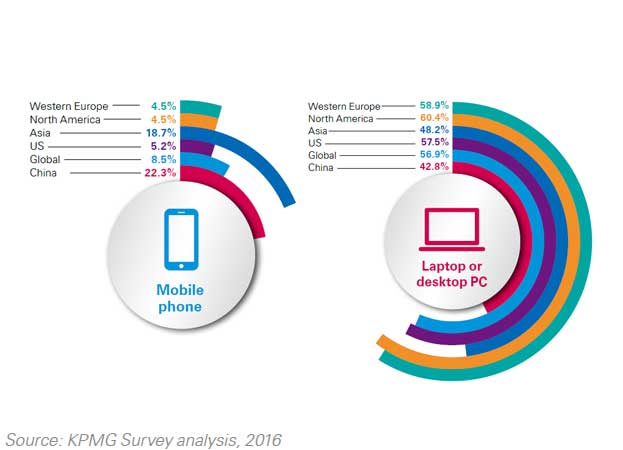

According to recent KPMG online consumer behavior report, smartphone remains the primary device for online purchases – well ahead of other countries, while laptop and desktop PC are used the least.

There is a number of main drivers behind Chinese m-commerce rapid development:

- Highly developed mobile payment ecosystem.

The primary systems are Alipay and WeChat Pay which are ruling Chinese m-commerce as well as becoming an increasingly common payment method offline. They also enjoy high degree of consumers’ confidence in payment security; - Large number of mobile users.

According to data from the Ministry of Industry and Information Technology (MIIT), China’s mobile users exceeded 1.3 billion at the end of 2015, with 29.6 percent of them using 4G. Furthermore, China sold 457 million smartphones in 2015, up 17.7 percent from 2014; - Convenience and accessibility.

Chinese m-commerce has leveled the playing field for all types of consumers regardless of location. While physical stores of some brands may not be available in 3rd and 4th tier cities, the shoppers can still gain the same access to brands as that available to people living in major cities; - Continuously growing economy.

Last but not least is the fact that, despite the recent slowdown, Chinese economy continues growing at about 6.7 percent rate. In recent years, this growth has been primarily driven by local consumption with e-commerce being large part of it.

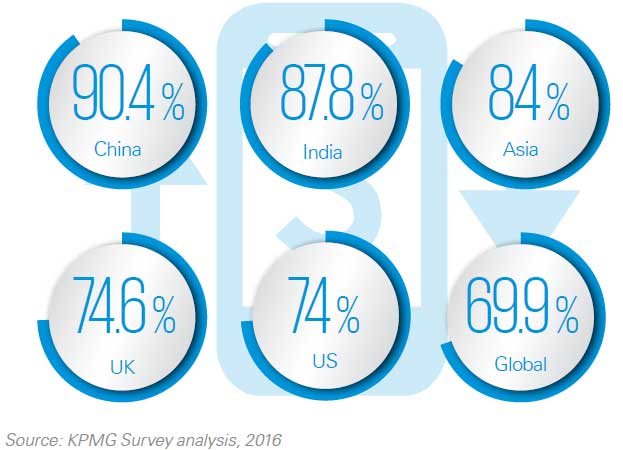

KPMG survey shows that more than 90 percent of the respondents made at least one online purchase using a smartphone in the past 12 months:

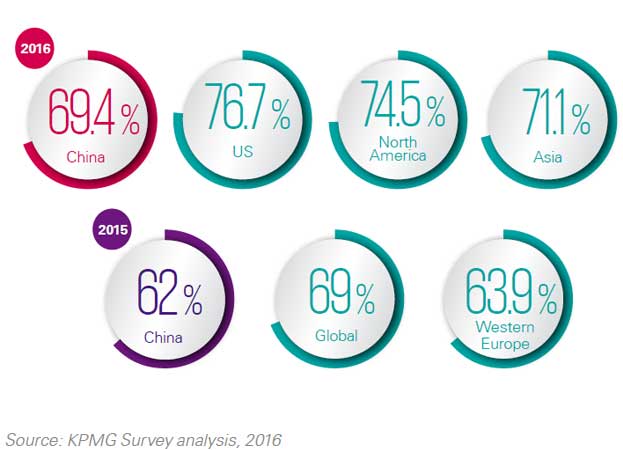

Consumers often research products using smartphones while in physical shops. In China, nearly 70 percent of respondents have looked up a product on their smartphone or tablet while being in a brick and mortar store. While this figure is still slightly smaller compared to other parts of the world, it is higher than the previous year. Also, this type of consumer behavior is likely to be gaining momentum after rolling out the new feature of Taobao and Tmall mobile apps allowing instant product search from a photo:

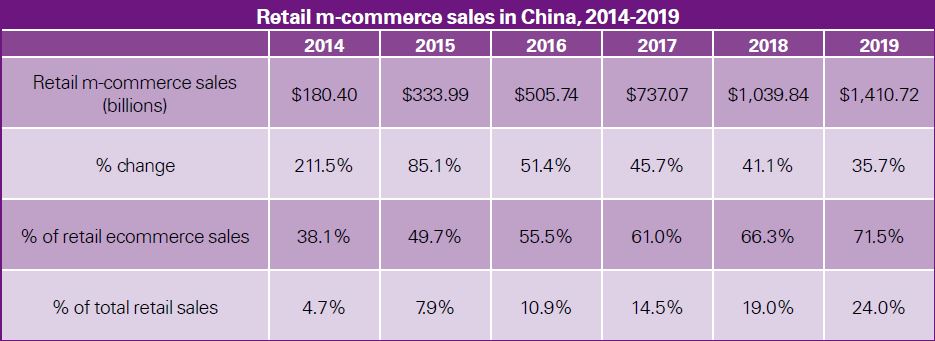

Market research company eMarketer estimates that Chinese m-commerce sales accounted for almost half the share of e-commerce sales in 2015. This year, retail mobile commerce sales in China are forecasted to grow by 51.4 percent to account for 55.5 percent of retail ecommerce sales in the country in 2016. By 2019, mobile users in China are expected to spend nearly $1.5 trillion on m-commerce:

Finally, China’s mobile commerce is another reason for the popularity of O2O concept. Companies, both local and multinational, are constantly on the lookout for more innovative ways to engage Chinese mobile consumers from all the angles.