Western companies looking to achieve better visibility in China’s vast internet landscape quickly find themselves in the unfamiliar territory. Traditional services by Google, Yahoo or Microsoft, that seem to be running the entire internet in the West, are reduced to the point of irrelevance by local competitors and some tricky government decisions that went along with that. The largest search engine in China is Baidu with 360 Search quickly gaining market share. The third largest service is called Sogou.

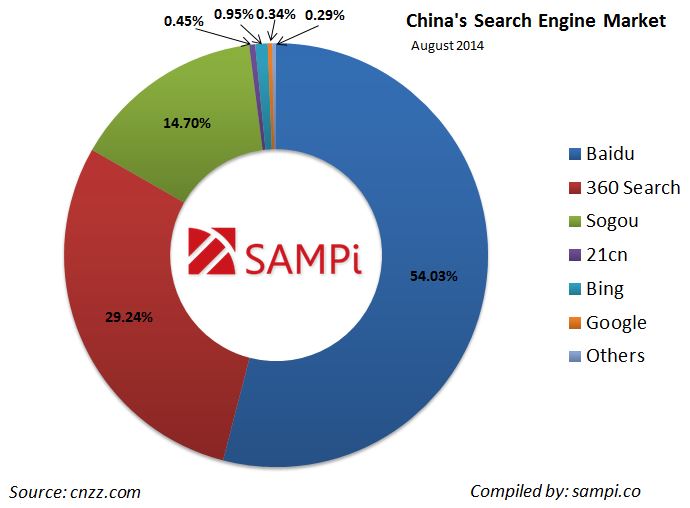

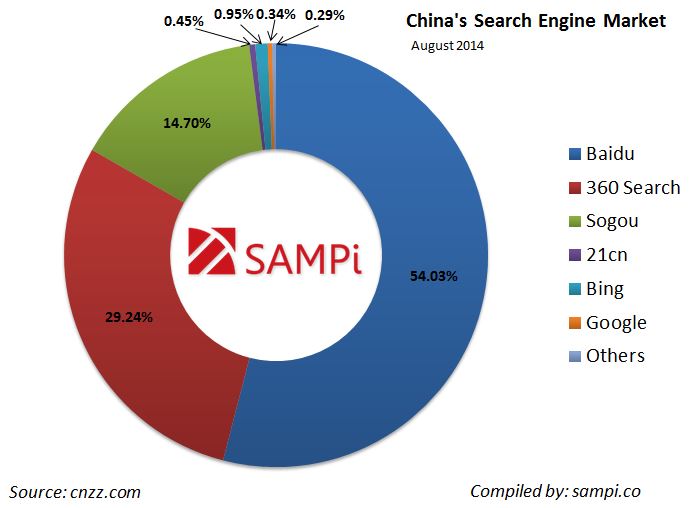

As of August 2014, Baidu still held 54% of the market, 360 Search was at almost 30% and growing with Sogou following the first two with about 15% of the total market:

Baidu market share overall has been surprisingly stable, remaining essentially flat throughout the first half of 2014. However, some figures indicate that the search volumes for videos, images as well as usage of other Baidu search products appeared to be reduced.

360 Search continues gaining popularity and is widely predicted to reach 35% of market share by the end of this year. It also offers lower prices for PPC compared to Baidu and there is an increasing perception that it returns more accurate search results overall.

Sogou is another service that has been showing various degrees of growth in the last year and it seems to firmly occupy the 3rd place in the market.

In terms of user experience, Google and Yahoo were ranked at the bottom, although Baidu wasn’t ranked too high either. According to the surveys by CNZZ.com, Sogou appeared to provide the best user experience. However, thanks to Baidu extensive ecosystem of related products and apps, it was still ranked at the top based on overall score.

Now, a bit about Google. China has been one of just a few countries on the globe where Google’s market share in search engine space remains insignificantly small. Although, the company had a consistent presence on the Mainland since 2005, its market share has been steadily declining. According to the latest data, it was around 1.3% at the beginning of this year, down from just about 2% a year earlier and compared to 12% in August 2012. The number dropped to the record low of 0.34% in August this year, most likely due to recent blocking of Google services in China in the first half of 2014.

These numbers simply mean that there is no point to optimize your site for Google in China or pay for Google AdWords to reach customers here. Baidu still remains the dominant player and should be the first to focus on in your marketing strategy. If 360 Search continues to keep up its good performance so far, it is likely to occupy a more prominent role in the market. The fact that it still offers better pay-per-click rates combined with highly accurate search results, makes this platform to become more attractive for marketers focusing on China.